The lab-grown diamond market is currently facing a slowdown characterised by a significant decline in sales growth and an oversupply problem leading to tumbling prices. Sales have dipped as unit growth falls below 20%, with revenues decreasing since mid-2023.

Overproduction and imports have flooded the market, prompting retailers to shift strategies, such as reducing inventories. As manufacturing advances lower production costs, prices could plummet by up to 80% within a year, particularly affecting the 1-2 carat segment. This market shift is driven by changing consumer preferences and intensified competition, altering the industry landscape. Uncover the complexities influencing this trend further.

Article Contents

- 1 Main Highlights

- 2 Indicators of Market Deceleration

- 3 Price Dynamics and Implications

- 4 Evolving Consumer Preferences

- 5 Natural Diamond Market Challenges

- 6 Industry-Wide Impact

- 7 Frequently Asked Questions

- 7.1 What Are the Potential Environmental Impacts of Lab-Grown Diamond Production?

- 7.2 How Do Lab-Grown Diamond Marketing Strategies Differ From Natural Diamonds?

- 7.3 Are There Any Emerging Technologies Affecting Lab-Grown Diamond Quality?

- 7.4 What Role Do Cultural Trends Play in Diamond Purchasing Decisions?

- 7.5 How Do Lab-Grown Diamonds Impact Employment in the Traditional Diamond Industry?

- 8 Conclusion

Main Highlights

- Lab-grown diamond sales growth has slowed to single-digit percentages, indicating a market deceleration.

- Overproduction and high imports have caused oversupply, driving prices down and predicting a 50%-80% price drop within a year.

- Advancements in production technologies have lowered manufacturing costs, intensifying competition and pressuring prices.

- Retailers are adapting by reducing inventory and adopting consignment-based purchasing strategies in response to market conditions.

- Consumer preferences are shifting towards larger, affordable lab-grown diamonds, impacting the traditional diamond market.

Indicators of Market Deceleration

In recent months, the lab-grown diamond market has shown clear signs of deceleration, as evidenced by a thorough market analysis. Sales trends indicate a marked slowdown, with unit sales growth rates dropping below the 20% threshold, pointing to a significant shift in market dynamics.

Total revenue generated from these diamonds has also witnessed a decline in most months since July 2023, revealing deeper challenges within the industry. Retail interest, a critical component of sales trends, is waning, as retailers have started reducing their inventory, opting instead for consignment-based purchasing strategies.

This shift suggests a cautious approach to managing stock levels amidst uncertain demand. Furthermore, the industry’s pivot from bridal to fashion jewellery, led by major players like De Beers and Signet Jewelers, highlights an adaptation to changing consumer preferences. The pressure on gross margins is intensifying, as price declines outpace sales growth, squeezing profitability. This scenario is compounded by overproduction and high imports, leading to an oversupply that further exacerbates price reductions.

A particular concern is that over 98% of India’s rough lab-grown diamond imports originate from Hong Kong and the UAE, which contributes significantly to the oversupply issue. These indicators collectively paint a picture of a market facing significant headwinds, necessitating strategic adaptations to navigate the evolving landscape. As lab-grown diamonds are increasingly viewed as a separate, lower-priced market segment, their appeal is diminishing, contributing to the slowdown.

Price Dynamics and Implications

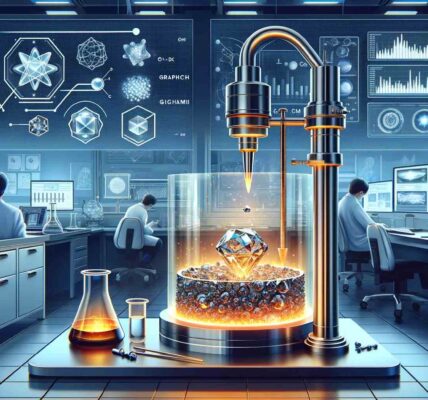

Amidst the evolving landscape of the lab-grown diamond market, price dynamics are playing a pivotal role in shaping the industry’s trajectory. Rapid advancements in production technologies, such as HPHT and CVD, have drastically reduced the time and costs associated with manufacturing these gems. This efficiency allows companies to adopt aggressive pricing strategies, particularly in the 1-2 carat segment, which is popular for solitaire engagement rings.

As the market becomes saturated with new entrants, competition intensifies, leading to downward pressure on prices. Strategic responses from industry giants like De Beers, who have reduced prices for certain rough diamonds, further exemplify the shifting landscape. As the supply of lab-grown diamonds increases from controlled creation environments, the market faces additional pressure to adjust pricing to remain competitive. Despite this, the market share for LGD jewellery has remained at 10%, indicating a potential stabilisation amidst the competitive pressures. One possible reason for the stabilisation of market share for lab-grown diamond (LGD) jewellery could be attributed to the continued strong demand for natural diamonds, a market that De Beers continues to dominate. De Beers diamond production remains a significant player in the industry, and their strategic pricing adjustments may be influencing consumer perceptions and purchasing decisions. Additionally, the perceived value and allure of natural diamonds compared to lab-grown alternatives could also be contributing to the steady market share for LGD jewellery.

As lab-grown diamonds continue to segment into a distinct, lower-priced market, they cater to consumers who might eventually shift to natural stones. Despite growing market share, now at 20%, revenue trends indicate decreasing gross profits due to falling prices. Analysts predict further declines, with potential drops of 50%-80% as initial market excitement wanes.

Consequently, the industry is witnessing a pivot in pricing strategies, with the likelihood of lab-grown diamonds being repositioned within the fashion jewellery market, thereby impacting their perceived value and market segmentation.

Evolving Consumer Preferences

Driven by increasing ethical awareness and affordability, consumer preferences in the diamond market are particularly shifting towards lab-grown options. Sustainability concerns have become paramount, influencing purchasing behaviour considerably.

The demand for lab-grown diamonds has surged from 3. 5% in 2018 to a significant 18. 5% in 2023, with expectations to exceed 20% by the end of 2024. This trend is largely fuelled by the eco-conscious consumers who value the reduced environmental impact of lab-grown diamonds compared to their mined counterparts. Additionally, the growing awareness of the ethical concerns surrounding traditional diamond mining has also contributed to the rise in demand for lab-grown diamonds. As a result, the market for lab-grown diamonds is experiencing a shift in consumer preferences, and this is reflected in the labgrown diamond price trends. As technology continues to advance and production processes become more efficient, it is expected that the prices of lab-grown diamonds will become even more competitive compared to natural diamonds.

Technological advancements like Chemical Vapour Deposition (CVD) and High Pressure High Temperature (HPHT) have improved the quality and affordability of lab-grown diamonds, enhancing their appeal. The Asia Pacific region leads the market with a value of USD 7.56 billion in 2023, indicating strong regional demand and manufacturing capabilities.

Lab-grown diamonds offer a compelling value proposition with their unique and vibrant hues, appealing especially to the youth and working women seeking affordable yet ethically produced jewellery. These diamonds are not just a fashion statement but a reflection of personal values aligned with sustainability concerns.

The expanding market, projected to grow from USD 25.89 billion in 2024 to USD 74.45 billion by 2032, highlights a significant shift in consumer behaviour, as more individuals prioritise ethical production and affordability in their purchasing decisions.

As consumer awareness grows, lab-grown diamonds continue to capture the interest of diverse market segments, illustrating a profound evolution in consumer preferences within the diamond industry.

Natural Diamond Market Challenges

The natural diamond market is manoeuvring a complex landscape marked by a multitude of challenges. Declining mine production has led to supply constraints, with output plummeting from 175 million carats to just over 100 million. Ageing mines further tighten supply, as exemplified by limited new sources like Angola’s Luele mine. Despite these challenges, industry stakeholders are leveraging marketing strategies to sustain demand.

Marketing efforts aim to reinforce the intrinsic value of natural diamonds, particularly as global demand shifts, with India emerging as a key market player. Amidst these dynamics, 2024/future-of-natural-diamond-industry” target=”_blank” rel=”noreferrer noopener”>lab-grown diamonds (LGDs) have seen an increase in demand over the past five years, challenging the natural diamond market’s position. The recent forecast by De Beers CEO Al Cook suggests a gradual recovery of the natural diamond market in 2024, offering a glimmer of hope amidst ongoing market challenges. In response to the growing competition from LGDs, the natural diamond industry is doubling down on marketing efforts to highlight the unique properties and timeless allure of natural diamonds. As part of this push, the Tanishq and De Beers partnership aims to showcase the beauty and value of natural diamonds to consumers in the Indian market. By leveraging the expertise and resources of both companies, this collaboration seeks to strengthen the position of natural diamonds and drive demand in the ever-evolving global market.

As illustrated below, the juxtaposition of declining supply and evolving market dynamics presents a nuanced picture:

| Challenge | Impact |

|---|---|

| Declining Mine Production | Tightened supply constraints |

| Ageing Mines | Nearing end of operational life |

| Limited New Supply | Only one major new source expected |

| Global Demand Shifts | India outpaces China |

| Marketing Efforts | Reinforce diamond value |

While natural diamond prices face pressures, the industry’s strategic responses are designed to navigate these turbulent waters. Investments in technology and sustainability, alongside targeted marketing initiatives, are pivotal in maintaining the allure of natural diamonds. By emphasising traceability and uniqueness, companies endeavour to differentiate their offerings amidst evolving consumer preferences and a shifting global market landscape.

Industry-Wide Impact

The lab-grown diamond market is undergoing significant changes that have substantial implications across the entire diamond industry. As sales growth decelerates to single-digit percentages, retailers are compelled to reassess their strategies.

One notable shift is the decrease in inventory of lab-grown diamonds, opting instead for consignment models to mitigate the risks associated with fluctuating prices. This strategic pivot is essential as market competition intensifies, with lab-grown diamonds now accounting for approximately 20% of the total diamond market. The increasing preference for lab-grown diamonds has significantly affected the pricing of natural diamonds, causing them to decline over recent years.

Retailers face the challenge of balancing the allure of competitive pricing with the necessity of maintaining profitability amidst a potential 50%-80% price drop over the next year. The industry must adapt to the evolving landscape where price dynamics are heavily influenced by the decreasing costs of raw materials.

Retailers are expected to establish a price floor to guarantee sustainable margins, manoeuvring the delicate balance between affordability and profit. Meanwhile, the shift in consumer behaviour towards purchasing larger diamonds, fuelled by lower prices, further complicates market strategies.

As the popularity of lab-grown diamonds grows, traditional diamond producers are pressured to innovate and redefine their market positions, guaranteeing they remain competitive in a rapidly transforming industry. High-quality lab-grown diamonds are predominantly produced in India and the USA, contributing to the industry’s ability to meet growing consumer demand with advanced production capabilities.

Frequently Asked Questions

What Are the Potential Environmental Impacts of Lab-Grown Diamond Production?

The potential environmental impacts of lab-grown diamond production include significant energy consumption and greenhouse gas emissions. However, sustainable practices, such as utilising renewable energy sources, can mitigate these effects, offering a more eco-friendly alternative to traditional diamond mining.

How Do Lab-Grown Diamond Marketing Strategies Differ From Natural Diamonds?

Lab-grown diamond marketing strategies utilise branding tactics emphasising affordability, sustainability, and ethical production. These strategies shape consumer perceptions towards lab-grown diamonds as groundbreaking and responsible choices, contrasting with the luxury and exclusivity typically associated with natural diamonds.

Are There Any Emerging Technologies Affecting Lab-Grown Diamond Quality?

Emerging technologies in synthetic processes are greatly enhancing lab-grown diamond quality. Quality advancements, including improved colour and clarity control, enable the production of superior diamonds, offering consumers greater freedom to choose high-quality, ethically sourced alternatives to natural gemstones.

What Role Do Cultural Trends Play in Diamond Purchasing Decisions?

Cultural trends greatly influence diamond purchasing decisions by shaping consumer preferences and highlighting the cultural significance of diamonds. Understanding these trends allows consumers to make informed choices, aligning with their desire for individuality and cultural resonance.

How Do Lab-Grown Diamonds Impact Employment in the Traditional Diamond Industry?

Lab-grown diamonds considerably contribute to job displacement in traditional mining sectors, necessitating industry adaptation. This shift offers new opportunities in technology and manufacturing, fostering economic freedom through retraining, while posing challenges for regions reliant on natural diamond extraction.

Conclusion

The slowdown in the lab-grown diamond market signifies a pivotal change in the industry, driven by changing consumer preferences and price dynamics. As prices are anticipated to decline, the natural diamond sector faces its own set of challenges, potentially influencing market competition.

The evolving landscape necessitates strategic adaptation across the industry to address these emerging trends. This period of change underscores the importance of understanding consumer behaviour and market forces to navigate future developments successfully.