The global diamond industry faces an essential supply shortage as production remains 13% below pre-pandemic levels, with current output at 120 million carats in spite of an 11.9% increase in 2021. Market experts project a substantial deficit of 278 million carats by 2050, driven by mine closures, COVID-19 disruptions, and geopolitical tensions. Although demand continues to grow at 2-3% annually, particularly in Asia, the industry's limited production growth of 1-2% signals deeper challenges ahead.

Article Contents

- 1 Main Highlights

- 2 Frequently Asked Questions

- 2.1 How Do Synthetic Diamonds Compare to Natural Diamonds in Terms of Quality?

- 2.2 What Are the Environmental Impacts of Diamond Mining Operations Worldwide?

- 2.3 Can Diamonds Be Recycled or Repurposed From Existing Jewelry?

- 2.4 Which Countries Have Untapped Diamond Reserves for Future Mining?

- 2.5 How Do Geopolitical Tensions Affect Diamond Prices and Market Availability?

- 2.6 Share this:

- 2.7 Like this:

Main Highlights

- Global diamond production has fallen 13% below 2019 levels despite an 11.9% increase in 2021 to 120 million carats.

- Production has drastically declined from 175 million carats in 2005-2006, with the Argyle mine closure significantly impacting supply.

- Industry experts predict a substantial shortage of 278 million carats by 2050 as demand continues to outpace production.

- Natural diamond production growth remains limited at 1-2% annually while demand increases 2-3%, particularly in Asian markets.

- Supply is projected to decrease 16% by 2023, creating urgent pressure for industry adaptation and alternative sourcing strategies.

As global diamond production showed a modest recovery in 2021 with an 11.9% increase to 120 million carats, industry experts warn of an impending shortage that could reform the market for decades to come. In spite of this uptick, production levels remain 13% below 2019 figures, highlighting a concerning long-term production decline. The closure of the Argyle mine, coupled with difficulties in discovering new high-quality diamond resources, has significantly impacted global supply chains and intensified concerns about meeting future diamond demand. Production has experienced a dramatic drop from over 175 million carats in 2005-2006 to current levels.

The diamond industry faces multiple challenges beyond production constraints. The COVID-19 pandemic disrupted supply chains, whereas sanctions against Russian diamonds and growing environmental, social, and governance (ESG) concerns have complicated the market dynamics. These factors, combined with the rising popularity of lab-grown diamonds (LGDs), have created unparalleled pressure on natural diamond prices and availability. Botswana leads value production with one-third of the global diamond output. India's diamond processing sector accounts for 90% of global cutting and polishing operations, making it a crucial player in the supply chain. The jewelry market anticipates a steady 1-2% annual growth in global demand despite current challenges.

Industry projections paint a sobering picture of the future, with natural diamond production expected to grow at merely 1 to 2 percent annually until 2027, falling short of historical growth rates. This limited growth, contrasted with a projected demand increase of two to three percent annually, particularly in Asian markets like China and India, suggests a broadening supply-demand gap. By 2050, experts anticipate a substantial supply shortfall of approximately 278 million carats. Current market trends show smaller diamonds facing significantly reduced demand compared to their larger counterparts.

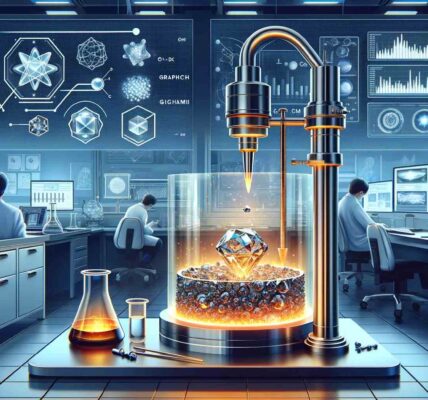

The emergence of lab-grown diamonds has introduced a new dimension to the market dynamics. These synthetic substitutes, sharing identical physical properties with natural diamonds, have gained traction by offering more affordable choices to consumers. This shift has prompted traditional diamond retailers to adapt their strategies, with the Indian diamond industry particularly pivoting toward domestic and ASEAN markets because of reduced demand from established markets in the U.S. and E.U.

The industry's response to these challenges reveals a complex adaptation process. Although global diamond jewelry retail sales are expected to decline by about 2%, the market is witnessing increased focus on supply chain transparency and sustainable practices.

The projected 16% decrease in diamond supply by 2023 underscores the urgency for industry stakeholders to develop creative solutions and substitute sourcing strategies. As the natural diamond shortage looms, the industry's ability to balance traditional practices with evolving market demands will determine its future path.

Frequently Asked Questions

How Do Synthetic Diamonds Compare to Natural Diamonds in Terms of Quality?

Like mirror images in nature's reflection, synthetic diamonds match natural diamonds in durability and physical properties, though market perception and traditional value still favor their earth-formed counterparts.

What Are the Environmental Impacts of Diamond Mining Operations Worldwide?

Diamond mining causes extensive habitat destruction through deforestation, generates substantial water pollution from chemical runoff, depletes water resources, and creates lasting environmental damage through mineral waste and land degradation.

Can Diamonds Be Recycled or Repurposed From Existing Jewelry?

Diamond recycling allows stones to be removed from existing jewelry, cleaned, and certified for repurposing into new pieces, offering a sustainable option to newly mined diamonds.

Which Countries Have Untapped Diamond Reserves for Future Mining?

The Democratic Republic of Congo and Angola possess significant untapped reserves for future mining. Russia plans to reopen Mir Mines, whereas Botswana and Namibia maintain promising diamond-rich territories.

How Do Geopolitical Tensions Affect Diamond Prices and Market Availability?

Geopolitical instability disrupts diamond supply chains, causing market fluctuations and price increases. Sanctions, trade tensions, and regional conflicts impact availability, as consumer sentiment responds to global uncertainty through shifting demand patterns.