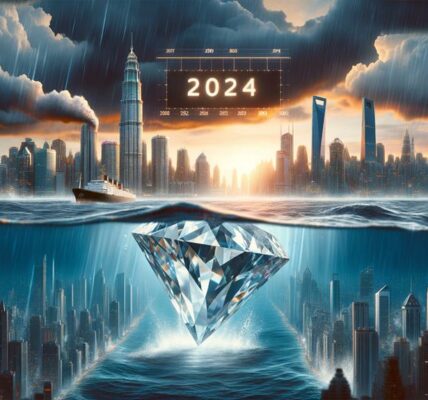

The global diamond industry is experiencing its most severe downturn in a decade, with revenues dropping to $12 billion. This decline stems from multiple factors, including competition from lab-grown diamonds, shifting consumer preferences, and economic uncertainties. Major mining companies have seen a collective $2 billion decrease in rough diamond sales, as well as the market share of top producers has contracted from 86% to 73%. The industry's transformation continues to unfold with emerging trends in sustainable practices and technological innovations.

Article Contents

- 1 Main Highlights

- 2 Frequently Asked Questions

- 2.1 How Do Lab-Grown Diamonds Impact Traditional Diamond Mining Communities?

- 2.2 What Alternative Investments Are Diamond Industry Workers Pursuing During the Crisis?

- 2.3 How Long Does It Typically Take for the Diamond Market to Recover?

- 2.4 Which Diamond Cuts Maintain the Highest Value During Market Downturns?

- 2.5 Are Smaller Diamond Retailers More Affected Than Large Corporations by This Decline?

- 2.6 Share this:

- 2.7 Like this:

Main Highlights

- Diamond industry revenue has plummeted to its lowest point in a decade, with current earnings at approximately $12 billion.

- India's diamond polishing sector faces a severe 25-27% decline, marking the third consecutive year of industry contraction.

- Major mining companies have experienced a collective $2 billion decrease in rough diamond sales over the past decade.

- Lab-grown diamonds' rising popularity and ethical concerns have contributed to a 12.34% drop in natural diamond prices.

- High mining costs and market oversupply have caused a 10-15% fall in diamond prices, squeezing industry profits.

As the global diamond industry grapples with shifting consumer preferences and market dynamics, revenue from natural diamond sales has plummeted to its lowest point in a decade. Recent revenue analysis reveals that India's diamond polishing industry, an essential sector in the global diamond market, is projected to experience a stark 25-27% decline, bringing revenues down to approximately $12 billion. This downturn marks the third consecutive fiscal year of contraction, reflecting broader challenges facing the traditional diamond market. Diamond exports to China have seen significant declines due to shifting consumer preferences toward gold jewelry.

The industry's struggles are particularly evident in the performance of major mining companies. The top three miners – De Beers, ALROSA, and Rio Tinto – have witnessed a collective $2 billion decrease in rough diamond sales over the past decade, whereas their market share has contracted from 86% to 73%. Despite global exports suffering an 8% decline since 2010, the industry continues to face significant headwinds. In spite of maintaining or increasing production levels, these companies have faced a 26% reduction in average prices per carat from 2010 to 2019. Geopolitical tensions and Russian sanctions have further disrupted traditional supply chains.

Market trends indicate a significant shift in the direction of lab-grown diamonds, which are expected to double their market presence by 2025. This transformation is driven by multiple factors, including growing environmental consciousness, ethical considerations, and more attractive pricing choices for consumers. Natural diamond prices have experienced a 12.34% price drop as consumers increasingly prefer synthetic alternatives. The United States and India are emerging as primary growth markets for lab-grown diamonds, with the UAE showing promising potential for market expansion. The industry's adoption of AI in grading diamonds has revolutionized quality assessment processes.

The traditional diamond sector's challenges extend beyond competition from synthetic substitutes. High mining costs, declining demand because of ethical concerns, and oversupply have contributed to a 10-15% fall in diamond prices. Operating margins for diamond processing companies are expected to stabilize at 4.5-4.7% in fiscal 2025, primarily because of reduced working capital requirements.

In light of these challenges, the global diamond market shows signs of potential recovery. Forecasts suggest growth from $2.52 billion in 2024 to $2.66 billion in 2025, with a projected reach of $3.35 billion by 2029. This growth path is supported by sustained jewelry demand, increasing affluence in emerging markets, and innovations in marketing and retail strategies, particularly those emphasizing sustainable and ethical sourcing.

The industry's transformation reflects a broader evolution in consumer preferences and market dynamics. Although traditional natural diamonds face exceptional challenges, the sector's adaptation to changing consumer demands and sustainability requirements will likely determine its future direction.

The increased focus on sustainable sourcing and ethical practices suggests a fundamental shift in how the diamond industry operates and markets its products to modern consumers.

Frequently Asked Questions

How Do Lab-Grown Diamonds Impact Traditional Diamond Mining Communities?

Lab-grown diamonds promote sustainable mining practices during challenging community resilience, simultaneously reducing environmental damage and traditional employment opportunities in mining regions where communities have historically depended on diamond extraction.

What Alternative Investments Are Diamond Industry Workers Pursuing During the Crisis?

Diamond industry workers are expanding into real estate investments and launching online businesses, as some are acquiring new skills in technology and digital commerce to create substitute income streams.

How Long Does It Typically Take for the Diamond Market to Recover?

Diamond market recovery typically spans 2-3 years based on historical trends, though current economic uncertainties, shifting consumer preferences, and global market dynamics may extend this timeline considerably.

Which Diamond Cuts Maintain the Highest Value During Market Downturns?

Round brilliant cuts consistently maintain the highest value, followed by antique diamonds with unique characteristics. These cuts preserve worth as a result of their enduring popularity and limited availability during downturns.

Are Smaller Diamond Retailers More Affected Than Large Corporations by This Decline?

Small retailers face devastating impacts from industry decline, lacking economies of scale and digital resources. Large corporations demonstrate resilience through robust supply chains, marketing capabilities, and financial reserves to weather market downturns.