Diamond Industry in Free Fall: Global Exports Crash 35% as Market Hits Breaking Point

Article Contents

- 1 Main Highlights

- 2 Frequently Asked Questions

- 2.1 What Role Do Synthetic Diamonds Play in the Current Market Crisis?

- 2.2 How Are Small-Scale Diamond Miners Surviving During This Industry Downturn?

- 2.3 Which Alternative Investments Are Diamond Investors Turning to Instead?

- 2.4 Can the Diamond Industry Recover Without Major Structural Changes?

- 2.5 How Are Diamond Certification Standards Evolving During This Market Transformation?

- 2.6 Share this:

- 2.7 Like this:

Main Highlights

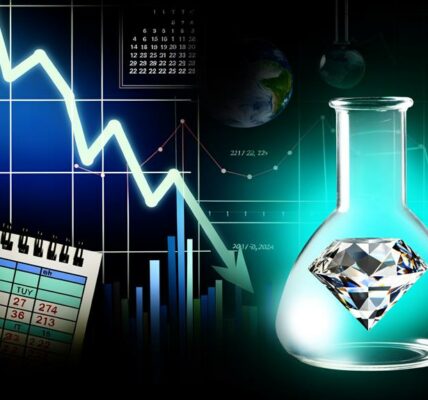

- Global exports of cut and polished diamonds have plummeted by 34.6%, indicating severe industry distress and market instability.

- Diamond processing hubs are experiencing widespread factory closures and job losses, particularly in major centres like Surat, India.

- Unsold diamond inventory has increased significantly from 35% to 45.6%, creating financial pressure on producers and retailers.

- Young consumers’ shift towards synthetic diamonds and experiences over traditional jewellery has accelerated market decline.

- The industry faces multiple challenges including reduced production, falling profit margins, and disrupted supply chains amid economic uncertainty.

The global diamond industry is experiencing an unprecedented downturn as multiple challenges converge to threaten its long-standing dominance in the luxury goods market. Recent data reveals a staggering 34.6% decline in exports of cut and polished diamonds, reflecting significant shifts in market dynamics and consumer behaviour. This extraordinary downturn stems from reduced spending in key markets like the United States and China, where economic uncertainties have dampened enthusiasm for luxury purchases. Production decline from 175 million carats to 121 million carats between 2005 and 2023 has intensified market pressures.

The industry’s challenges are further complicated by changing consumer preferences, particularly among younger generations who increasingly prioritise experiences over traditional material investments. The growth of lab-grown diamond sales has accelerated dramatically over the past year, signalling a major shift in consumer acceptance. The combination of this shift, global economic instability, and geopolitical tensions has led to significant market disruptions and declining sales for diamond producers and retailers worldwide. Retail profit margins have dropped significantly, with many retailers experiencing a 20-25% decrease in earnings.

Adding to these pressures, synthetic diamonds have emerged as a formidable competitor in the marketplace. Kimberley Process Certification remains crucial for preventing conflict diamonds from entering legitimate markets. These laboratory-created substitutes offer environmentally conscious consumers a more sustainable and cost-effective choice, directly challenging the traditional diamond industry’s market share. The growing acceptance of synthetic diamonds, especially among younger buyers, has forced natural diamond producers to reassess their business strategies and market positioning.

The impact of these challenges is particularly evident in major diamond processing hubs like Surat, India, where factory closures and job losses have become increasingly common. The industry faces mounting operational costs and diminishing profit margins, as unsold inventory levels have surged from 35% to 45.6%.

International sanctions and supply chain disruptions have further exacerbated these difficulties, highlighting the vulnerability of an industry heavily dependent on global trade networks.

Despite these challenges, industry experts project a potential recovery beginning in 2025, contingent upon global economic stabilisation and renewed consumer confidence. Diamond producers are actively exploring creative approaches to improve operational efficiency and adapt to evolving market demands. These efforts include enhancing supply chain transparency and developing new market opportunities to guarantee long-term sustainability.

The industry’s future hinges on its ability to manoeuvre through these fundamental changes while maintaining its appeal in an increasingly competitive luxury market. As traditional markets evolve and new challenges emerge, the diamond industry must transform itself to meet changing consumer expectations and market realities, marking a pivotal turning point in its centuries-old history.

Frequently Asked Questions

What Role Do Synthetic Diamonds Play in the Current Market Crisis?

Synthetic diamonds generate intense market competition by providing lower-cost alternatives, resulting in price reductions across the industry as they gain significant market share, particularly in the fashion jewellery and bridal segments.

How Are Small-Scale Diamond Miners Surviving During This Industry Downturn?

Like cats with nine lives, small-scale mining operations demonstrate economic resilience through diversification into other minerals, implementing cost-saving measures, and maintaining flexible structures that adjust to market changes.

Which Alternative Investments Are Diamond Investors Turning to Instead?

Diamond investors are diversifying into established tangible assets such as real estate and art investments, pursuing more stable returns while maintaining the prestige of luxury alternative investments.

Can the Diamond Industry Recover Without Major Structural Changes?

In order to recover, the diamond industry needs to implement fundamental market strategies and shift consumer behavior, which include digital transformation, sustainability practices, and adapting to changing preferences.

How Are Diamond Certification Standards Evolving During This Market Transformation?

Certification evolution highlights improved market transparency through advanced technology integration, stricter origin tracking, and expanded grading parameters, helping maintain consumer trust as it adapts to modern sustainability and authenticity demands.