Prices for Higher-Clarity Diamonds Are Still Falling

The diamond market experienced a slowdown in April due to various factors.

Article Contents

Market Trends in April

The 3.5% decrease in the 1-carat RAPI was a major factor in the April price decline for higher-clarity diamonds. Due to seasonal variations and declining demand from important markets like the US and China, the diamond market experienced a slowdown during this time. Prices of VS-plus diamonds witnessed a decrease, whereas SIs showed improvement, continuing a trend that has persisted since the beginning of the year.

BHP’s substantial $38.9 billion bid for Anglo-American stirred discussions regarding the future trajectory of De Beers. Apart from this major bid, reports suggested that Anglo was exploring the possibility of selling De Beers in a separate process, potentially leading to a significant restructuring of the diamond market. De Beers found itself under intense pressure from various factors, including competition from synthetic diamonds, political uncertainties, and a noticeable decline in Chinese demand.

Polished diamond sales faced a sluggish period in April, with challenges arising from high inflation rates and increased interest rates affecting consumer spending in the US market. Chinese consumers, on the other hand, displayed a preference for investing in gold rather than diamonds during this time.

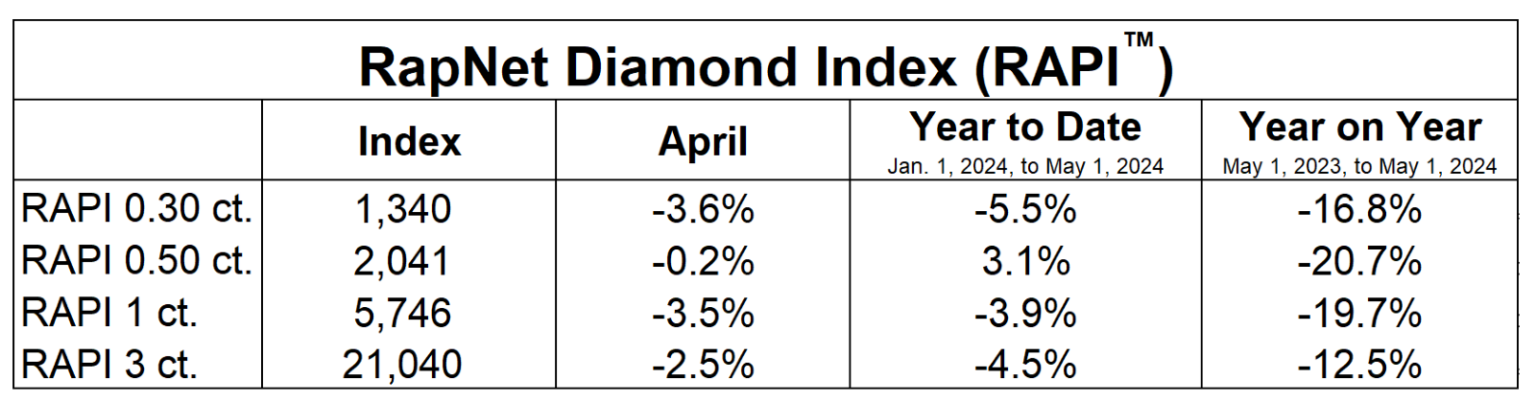

Regarding market indices, the RapNet Diamond Index (RAPI™) for 1-carat diamonds, reflecting round shapes with D to H color grades and IF to VS2 clarity, witnessed a significant 3.5% decline in April and a substantial drop of nearly 20% compared to the previous year. Conversely, prices for round 1-carat diamonds with D to H color grades and SI clarity saw a modest 1% increase during the same month.

The downturn in the polished diamond industry significantly impacted market activity in the rough diamond segment. Dealers faced challenges generating profits from most De Beers boxes within the secondary market. Notably, rough diamond sales at Botswana’s state-owned Okavango Diamond Company plummeted by 68% year-on-year to $34.6 million in April. De Beers adjusted its 2024 production forecast by approximately 10%, anticipating an output range of 26 million to 29 million carats.

External factors such as the Group of Seven (G7) sanctions on Russian diamonds created ripples in the market. The resignation of Ari Epstein as CEO of the Antwerp World Diamond Centre (AWDC) was emblematic of the controversies surrounding the implementation of European Union regulations, leading to delays at the city’s customs office. Plans to designate Antwerp as the primary inspection point for all diamonds entering G7 nations encountered resistance from various industry stakeholders.

Industry attention gradually shifted towards the upcoming Las Vegas shows, with hopes pinned on these events to invigorate the wholesale market ahead of the approaching holiday season.

Polished Sales and Rough Market

Amidst the fluctuations in the diamond market, the month of April witnessed a downturn in sales, primarily influenced by various economic and market-related factors.

The slowdown in the diamond market during April can be attributed to seasonal variations and subdued demand from key markets such as the United States and China. Notably, prices of higher-clarity diamonds, specifically VS-plus goods, experienced a decline, contrasting with the improvement seen in SI diamonds, a trend that has persisted since the beginning of the year.

Furthermore, the market buzz intensified following BHP’s staggering $38.9 billion bid for Anglo American, sparking speculations about the future trajectory of De Beers. As reports surfaced about Anglo’s potential divestment of De Beers, discussions on a prospective restructuring of the diamond market gained traction. The diamond industry, already grappling with challenges posed by synthetic diamonds, geopolitical uncertainties, and a dip in Chinese demand, found itself at a critical juncture.

Notably, polished diamond sales faced a sluggish period throughout April. The impact of high inflation and interest rates was notably felt in the US market, leading to subdued consumer spending. On the other hand, Chinese consumers exhibited a preference for investing in gold over diamonds, further dampening the demand for polished diamonds.

The RapNet Diamond Index (RAPI™) for 1-carat diamond goods, reflecting round diamonds ranging from D to H color grades and IF to VS2 clarity, recorded a notable decline of 3.5% in April, marking almost a 20% decrease compared to the previous year. Meanwhile, prices for round 1-carat diamonds with D to H color grades and SI clarity witnessed a marginal 1% increase during the same period.

Conversely, the rough diamond market faced its own set of challenges, mirroring the subdued performance in the polished segment. Dealers encountered difficulties in generating profits from De Beers boxes in the secondary market, reflecting the overall market sentiment. Notably, rough diamond sales at Botswana’s state-owned Okavango Diamond Company plummeted by 68% year-on-year to $34.6 million in April, underlining the prevailing market constraints.

The diamond market also had to navigate through the ramifications of Group of Seven (G7) sanctions on Russian diamonds, adding another layer of complexity to the industry dynamics. The resignation of Ari Epstein as CEO of the Antwerp World Diamond Centre (AWDC) further underscored the challenges faced by the industry, particularly concerning the implementation of European Union regulations, which caused delays at the city’s customs office.

As industry players turned their attention towards the upcoming Las Vegas shows, there were hopes that these events would catalyze the wholesale market, setting the stage for a potential revival leading up to the holiday season.

Impact of G7 Sanctions and Industry Controversies

Amidst the fluctuations in the diamond market, the impact of external factors like the Group of Seven (G7) sanctions on Russian diamonds has been significant. These sanctions have disrupted the industry, causing ripples that are felt globally.

The recent resignation of Ari Epstein as the CEO of the Antwerp World Diamond Centre (AWDC) has brought to light the controversies surrounding the implementation of European Union rules. Delays at the Antwerp customs office have added to the challenges faced by industry players.

Plans to designate Antwerp as the single inspection point for all diamonds entering G7 countries have not been without opposition. Various stakeholders in the industry have raised concerns about the practicality and implications of such a move.

These industry controversies have created a sense of uncertainty among diamond traders and manufacturers. The need for clarity and swift resolutions to these issues is paramount to ensure the smooth functioning of the market.

- G7 sanctions on Russian diamonds affected the market dynamics.

- Controversies over EU rules have led to delays at the Antwerp customs office.

Upcoming Las Vegas Shows and Market Expectations

The diamond market experienced a slowdown in April, influenced by seasonal fluctuations and weakened demand from the US and China. While prices of higher-clarity diamonds, specifically VS-plus goods, contracted, lower clarity grades like SIs saw marginal improvements, aligning with trends seen earlier in the year.

Amidst this market environment, BHP’s unprecedented bid for Anglo American created uncertainty around the future of De Beers. Reports suggest that Anglo American is considering selling De Beers in a move that could potentially reshape the diamond market. This decision comes as the company faces growing competition from synthetic diamonds, geopolitical hurdles, and a decline in Chinese demand.

However, polished diamond sales remained sluggish in April. Rising inflation rates and interest costs in the US restrained consumer spending, with Chinese buyers showing a preference for gold investments over diamonds. Furthermore, the uncertainty surrounding the ongoing trade tensions between the US and China also contributed to the slowdown in diamond sales. This was evident at the recent Bonhams London jewelry auction, where the demand for diamonds was noticeably weaker compared to previous auctions. The auction saw a shift in consumer interest towards other precious gemstones and vintage jewelry pieces, reflecting the current market trend of cautious and selective spending within the fine jewelry sector.

The RapNet Diamond Index (RAPI™) for 1-carat diamonds, particularly round, D to H color range, IF to VS2 clarity, witnessed a notable 3.5% decline in April, marking nearly a 20% year-on-year decrease. Conversely, prices for round, 1-carat diamonds in the D to H color range with SI clarity rose by 1% during the same period.

On the rough diamond front, the market faced challenges mirroring the subdued polished segment. Dealers encountered difficulties in realizing profits on most De Beers boxes in the secondary market, while rough diamond sales at Botswana’s Okavango Diamond Company plummeted by 68% year on year to $34.6 million. In response to market conditions, De Beers revised its 2024 production forecast downwards by approximately 10%, projecting an output range between 26 million to 29 million carats.

Further, the diamond market felt the impacts of Group of Seven (G7) sanctions on Russian diamonds, alongside internal disruptions within diamond trade bodies. The resignation of Ari Epstein as CEO of the Antwerp World Diamond Centre (AWDC) highlighted tensions surrounding the implementation of European Union regulations, causing delays at customs offices in the city.

The trade’s attention has now turned towards the upcoming Las Vegas shows, with optimism that these events will stimulate the wholesale market ahead of the forthcoming holiday season.

1 COMMENTS